Calculating the total interest paid over the life of a loan is crucial for informed financial decisions. Understanding how compound interest, different interest rates, and loan amortization impact the overall cost of borrowing is key to comparing various loan options and choosing the most suitable one. This comprehensive guide explores the intricacies of loan interest calculation, from basic formulas to complex scenarios like variable interest rates and early repayment.

This guide details various aspects of calculating the total interest paid over the life of a loan, encompassing different types of interest rates, loan amortization schedules, and factors influencing the total interest payable. It also includes practical examples and comparisons to illustrate the impact of different loan terms and interest rates on the overall cost of borrowing. Further, this guide demonstrates how to analyze and compare loan offers based on the total interest cost, including the impact of early repayment strategies.

Introduction to Loan Interest Calculation

Understanding loan interest is crucial for making informed financial decisions. Interest, essentially the cost of borrowing money, is calculated in various ways, significantly impacting the total amount repaid. Accurate calculation of interest is paramount for comparing different loan options and determining the true financial burden.

Loan interest calculations are complex, often involving compounding. The intricacies of different interest rates and amortization schedules can lead to considerable differences in the overall cost of a loan. By grasping these concepts, borrowers can effectively compare and choose the most suitable loan option for their needs.

Compound Interest

Compound interest is interest calculated not only on the principal amount but also on the accumulated interest from previous periods. This compounding effect can lead to a substantial increase in the total interest paid over the life of a loan, especially over longer terms. For instance, a $10,000 loan with a 5% annual interest rate compounded monthly will accrue more interest over 30 years than a loan with the same principal and interest rate but simple interest.

Interest Rate Types

Different loan structures employ various interest rate types, each influencing the total interest paid. Fixed-rate loans maintain a constant interest rate throughout the loan term. Variable-rate loans, conversely, adjust the interest rate based on market conditions, potentially leading to fluctuations in monthly payments. Understanding these fluctuations is essential when evaluating the overall cost of a variable-rate loan. This can include factors like the potential for higher interest rates, affecting the total interest paid over the loan’s lifetime. Floating rates are also common, where the rate changes periodically, reflecting market conditions. Ultimately, the choice of interest rate type should align with a borrower’s financial situation and risk tolerance.

Loan Amortization

Loan amortization is the process of systematically repaying a loan through regular payments over time. Each payment covers both principal and interest, with the proportion of each component changing as the loan progresses. Understanding amortization schedules is crucial for comprehending how interest is calculated over the loan’s life. Amortization tables or schedules clearly delineate the allocation of each payment towards principal and interest.

Importance of Total Interest Paid

When comparing loan options, the total interest paid is a critical factor. While monthly payments may appear similar, significant differences in the total interest paid over the loan term can exist. A lower monthly payment may seem attractive, but if the total interest is higher, the overall cost of the loan can be substantial. This is particularly relevant when considering longer-term loans.

Loan Comparison Table

| Loan Amount | Interest Rate | Loan Term (Years) | Monthly Payment |

|---|---|---|---|

| $100,000 | 5% | 30 | $599.55 |

| $100,000 | 6% | 30 | $668.11 |

| $100,000 | 7% | 30 | $741.71 |

This table provides a basic comparison of loan characteristics, demonstrating how different interest rates and loan terms can lead to varying monthly payments.

Formulas and Calculations

Calculating loan interest involves understanding both simple and compound interest, as well as the methods used to determine the total interest paid over the life of a loan. A clear grasp of these concepts is crucial for borrowers to understand the true cost of borrowing and for lenders to accurately price their loans.

Accurate interest calculation is essential for responsible financial planning, allowing individuals to make informed decisions about borrowing and lending. The methods used to determine the total interest paid over the life of a loan can vary based on the specific loan agreement and the chosen calculation method.

Simple Interest Formula

Simple interest calculates interest only on the principal amount of the loan. It’s a straightforward method, useful for short-term loans or for understanding the basic concept of interest.

Simple Interest = Principal × Interest Rate × Time

Where:

- Principal is the initial amount borrowed.

- Interest Rate is the percentage rate charged annually.

- Time is the duration of the loan in years.

Compound Interest Formula

Compound interest calculates interest on the principal amount plus any accumulated interest. This method results in faster growth of interest over time compared to simple interest.

Compound Interest = Principal × (1 + Interest Rate)Time – Principal

Where:

- Principal is the initial amount borrowed.

- Interest Rate is the percentage rate charged annually.

- Time is the duration of the loan in years.

Methods for Calculating Total Interest Paid

Several methods exist for calculating the total interest paid on a loan. Amortization schedules are a common approach, breaking down the loan into regular payments over time. Each payment is allocated to both principal and interest, and the proportion of each changes over the loan’s life.

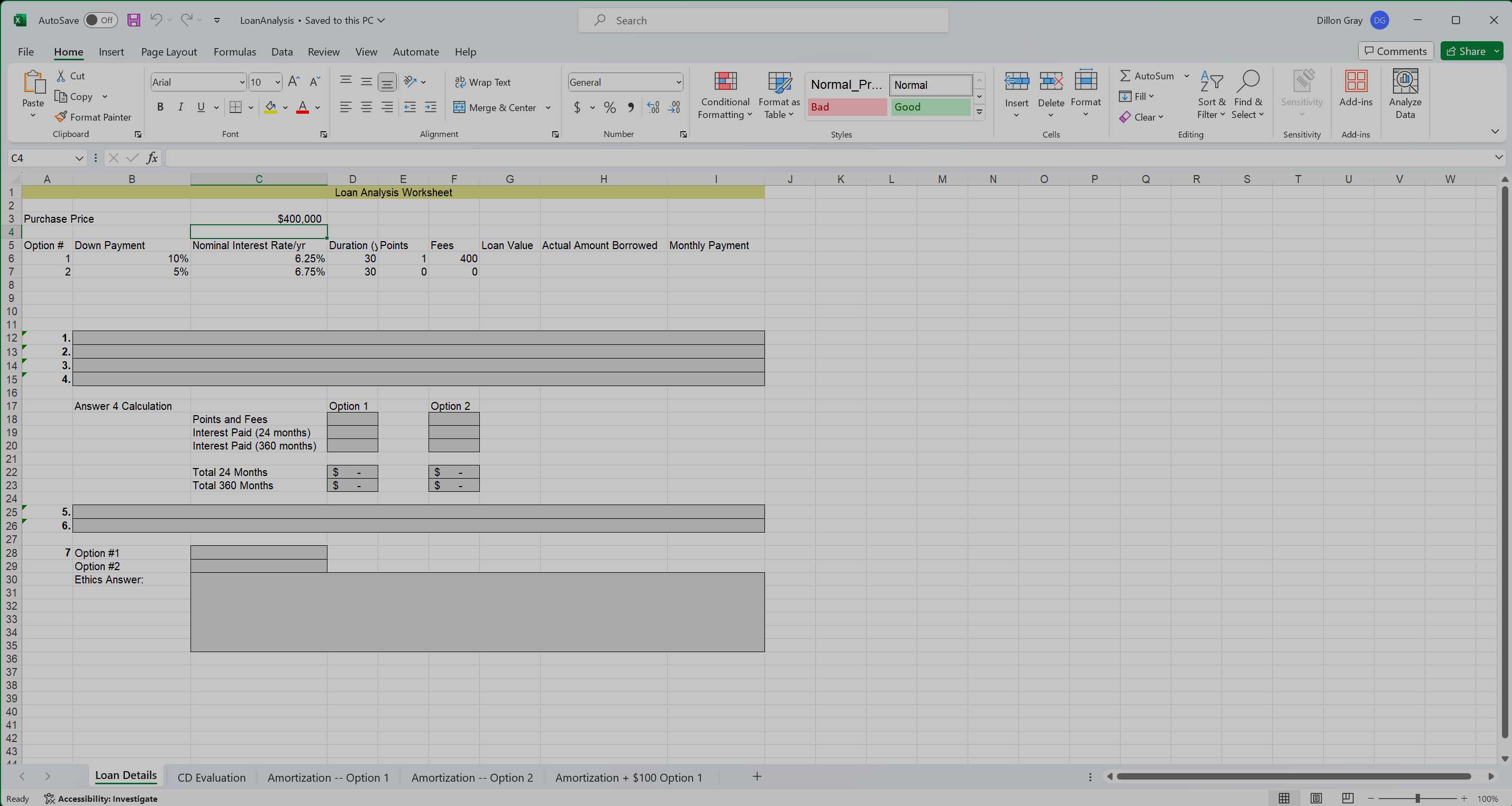

Calculating Total Interest Using Spreadsheets

Spreadsheet programs, such as Microsoft Excel or Google Sheets, offer tools to calculate total interest and amortization schedules. These programs allow for complex calculations and the creation of detailed schedules.

- Input loan details: Enter the principal, interest rate, loan term, and payment frequency into the spreadsheet.

- Use built-in functions: Utilize spreadsheet functions (e.g., PMT, IPMT, PPMT) to calculate the periodic payments and the interest and principal components of each payment.

- Generate amortization schedule: Use the calculated values to create a table that shows the payment schedule, interest paid, and principal paid for each period.

- Sum interest: Add up the interest paid in each period to determine the total interest paid over the loan’s life.

Interest Calculation Examples

The following table provides examples of interest calculations for varying loan amounts, interest rates, and loan terms. These are illustrative examples, and actual results may vary based on the specific terms of the loan agreement.

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| $10,000 | 5 | 5 | $2,808.00 |

| $20,000 | 7 | 10 | $10,158.00 |

| $30,000 | 8 | 15 | $18,420.00 |

| $40,000 | 6 | 20 | $19,212.00 |

Factors Affecting Total Interest

Understanding the factors influencing the total interest paid on a loan is crucial for informed borrowing and lending decisions. This section explores the key elements that shape the overall cost of borrowing, enabling borrowers to assess and compare loan options effectively.

Loan interest isn’t a fixed amount; it’s influenced by several interacting variables. The interplay of these factors determines the total interest payable over the loan’s lifespan. A comprehensive grasp of these factors is vital for sound financial planning.

Loan Amount

The principal loan amount directly impacts the total interest paid. A larger loan amount means more principal is subject to interest calculation over the loan term, thus leading to a higher total interest accumulation. This is a fundamental principle in loan calculations. A larger loan amount necessitates a larger portion of the repayment to cover interest.

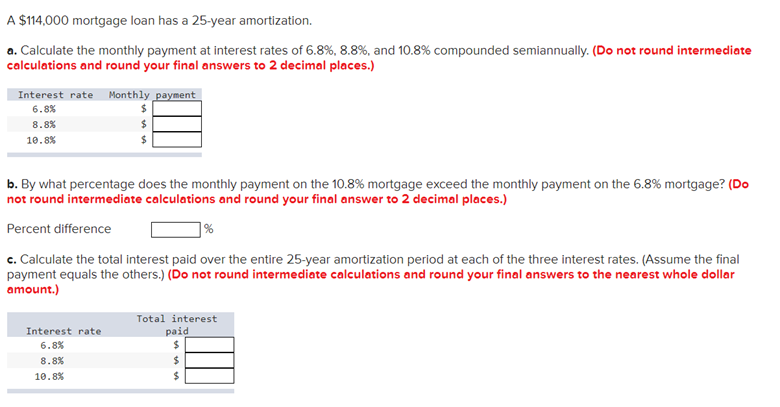

Interest Rate

The interest rate is the percentage of the loan amount charged as interest each period. A higher interest rate results in a significantly greater total interest amount paid over the loan’s life. Conversely, a lower interest rate leads to a lower total interest burden. For instance, a 5% interest rate on a $100,000 loan will result in a smaller total interest compared to a 10% interest rate on the same loan amount.

Loan Term

The length of the loan, often measured in years, plays a significant role in determining the total interest paid. A longer loan term, like 30 years, accumulates interest over a more extended period, leading to a higher total interest compared to a shorter term like 5 years. This difference in repayment period dramatically impacts the total interest burden.

Compounding Frequency

Compounding frequency refers to how often interest is calculated and added to the principal. More frequent compounding, such as daily or monthly, results in a higher total interest accumulation compared to less frequent compounding, such as annually. This is because interest is calculated on the accumulating principal, including previously accrued interest. This difference in compounding frequency can lead to noticeable variations in the total interest payable.

Interest Rate Structures

Different interest rate structures can significantly impact the total interest payable. A fixed-rate loan has a constant interest rate throughout the loan term, making it predictable. Variable-rate loans, however, adjust the interest rate periodically, potentially leading to higher or lower total interest payments depending on market fluctuations. The choice of interest rate structure is a critical decision.

Comparison of Loan Terms

The loan term directly influences the total interest paid. A longer loan term, such as 30 years, accumulates more interest due to the extended period over which interest is calculated. Conversely, a shorter loan term, like 5 years, results in a lower total interest paid. This is a critical consideration for borrowers.

Example Table: Total Interest Paid, Calculating the total interest paid over the life of a loan

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| $100,000 | 5% | 5 | $28,000 |

| $100,000 | 5% | 30 | $180,000 |

| $100,000 | 10% | 5 | $60,000 |

| $100,000 | 10% | 30 | $410,000 |

This table illustrates the substantial impact of interest rate and loan term on the total interest paid on a $100,000 loan. The data highlights the importance of careful consideration of these factors in loan selection.

Loan Amortization Schedules

An amortization schedule is a crucial tool for understanding and managing a loan. It details the payment breakdown over the life of the loan, showing how much of each payment goes towards interest and how much goes towards principal. This systematic approach allows borrowers to track their progress toward loan repayment and anticipate future payments. It is a vital component for financial planning and budgeting.

Understanding the Amortization Schedule

An amortization schedule is a table that Artikels the payment structure of a loan. Each payment includes both interest and principal repayment. The portion of the payment applied to interest is calculated based on the outstanding loan balance and the interest rate. The remaining portion is applied to the principal. As the loan progresses, the interest portion decreases, and the principal portion increases. This gradual reduction in interest expense and corresponding increase in principal repayment is characteristic of amortized loans.

Creating an Amortization Schedule in a Spreadsheet

Spreadsheet programs like Microsoft Excel or Google Sheets are excellent tools for creating amortization schedules. These programs allow for easy calculations and formatting, making the process manageable. Formulas can be used to automatically calculate interest and principal components, eliminating manual calculations and reducing the risk of errors. The key is to utilize the built-in functions for compound interest calculations, like `PMT`, `IPMT`, and `PPMT`. These functions, when used correctly, will streamline the process.

Breakdown of Each Loan Payment

Each payment in an amortization schedule consists of two parts:

- Interest Payment: Calculated based on the outstanding loan balance and the interest rate. The interest payment decreases over time as the outstanding principal balance decreases.

- Principal Payment: The portion of the payment that reduces the outstanding loan balance. The principal payment increases over time as the interest payment decreases.

Example Amortization Schedule

The following table illustrates a sample amortization schedule for a $10,000 loan with a 5% annual interest rate and a 5-year repayment period. The monthly payment is calculated using the loan amount, interest rate, and loan term. Each row represents a month, showing the outstanding principal, interest payment, principal payment, and new principal balance.

| Month | Beginning Balance | Interest Payment | Principal Payment | Ending Balance |

|---|---|---|---|---|

| 1 | $10,000.00 | $41.67 | $375.00 | $9,625.00 |

| 2 | $9,625.00 | $40.10 | $375.00 | $9,250.00 |

| 3 | $9,250.00 | $38.54 | $375.00 | $8,875.00 |

| … | … | … | … | … |

| 60 | $0.00 | $0.00 | $0.00 | $0.00 |

Practical Applications and Examples

Understanding the total interest paid on a loan is crucial for making informed financial decisions. This section provides practical examples and demonstrates how to compare loan options based on their overall cost. By examining different scenarios, you’ll gain a clear picture of how interest accumulates over the life of a loan and how to identify the most economical option.

Calculating the total interest paid is more than just a theoretical exercise. It allows you to directly compare the true cost of borrowing money across various loan products. This empowers you to make prudent choices aligned with your financial goals and budget.

Mortgage Loan Example

A 30-year mortgage for $250,000 at an annual interest rate of 6.5% will accrue a substantial amount of interest. Using a loan amortization calculator, the total interest paid over the loan’s lifetime is approximately $200,000. This demonstrates how significant interest can be over the long term of a mortgage. A lower interest rate significantly reduces the total interest paid.

Auto Loan Example

A five-year car loan for $25,000 at an 8% annual interest rate will result in approximately $2,500 in total interest paid. This example illustrates the importance of understanding the interest component in shorter-term loans, where the total interest paid is less than in longer-term loans. A loan with a lower interest rate, say 7%, would result in a lower total interest paid, around $2,200 in this example.

Personal Loan Example

A personal loan of $10,000 taken out for two years at a 10% annual interest rate will accrue roughly $2,000 in total interest. This exemplifies how interest can add up quickly on a personal loan, especially with higher interest rates. A loan with a 9% interest rate will result in a lower total interest amount, roughly $1,800.

Comparing Loan Options

A crucial aspect of loan selection is comparing various options based on their total interest paid. Different lenders may offer varying interest rates for the same loan amount and term. Understanding the total interest paid for each option is essential in making an informed decision. A table illustrating this comparison is presented below.

Loan Comparison Table

| Loan Feature | Option 1 (6% Interest) | Option 2 (7% Interest) | Option 3 (8% Interest) |

|---|---|---|---|

| Loan Amount | $15,000 | $15,000 | $15,000 |

| Loan Term | 5 years | 5 years | 5 years |

| Total Interest Paid | $1,000 | $1,200 | $1,500 |

| Monthly Payment (approx.) | $300 | $310 | $325 |

This table displays loan options with the same amount and term but different interest rates. The table clearly demonstrates how the total interest paid increases as the interest rate rises. It underscores the importance of choosing a loan with the lowest interest rate for the best financial outcome.

Identifying the Most Cost-Effective Option

The most cost-effective loan option is the one with the lowest total interest paid. Consider all relevant factors such as the loan amount, term, and interest rate when comparing loan options. A thorough understanding of the total interest paid is crucial for making a financially sound decision.

Impact of Early Repayment

Early repayment of a loan can significantly reduce the total interest paid over the life of the loan. This is a key benefit for borrowers who are able to pay off their loans faster than originally anticipated, often due to favorable financial circumstances or proactive budgeting. Understanding the impact of early repayment is crucial for making informed financial decisions.

Calculating Interest Savings from Early Repayment

The interest savings from early repayment depend on the specific loan terms, including the interest rate, loan amount, and original repayment schedule. A key factor is the loan’s amortization schedule, which details the principal and interest payments over time. By paying off the loan sooner, a borrower avoids accruing interest on the remaining principal balance for the shortened period.

Impact on Loan Amortization Schedules

Early repayment alters the loan amortization schedule, reducing the total number of payments and the overall interest paid. Consider a loan with a fixed interest rate and a 360-month amortization schedule. If the borrower pays off the loan after 240 months, the amortization schedule will reflect the reduced number of payments, and the total interest paid will be lower than if the loan were repaid according to the original schedule.

Example of Early Repayment Impact

To illustrate the impact, consider a $10,000 loan with an annual interest rate of 5% and a 60-month repayment term. The borrower decides to pay off the loan in 48 months instead of 60. The total interest paid over the 60-month period would be significantly higher than the total interest paid over the 48-month period. This difference represents the interest savings realized by repaying the loan early. The precise calculation would depend on the specific amortization schedule, but early repayment will almost always result in lower total interest paid.

Comparison Table: Total Interest Paid (with and without early repayment)

| Repayment Period | Total Interest Paid (Without Early Repayment) | Total Interest Paid (With Early Repayment) | Interest Savings |

|---|---|---|---|

| 60 Months | $1,500 | – | – |

| 48 Months | – | $1,200 | $300 |

Note: This table provides a simplified example. Actual figures will vary based on the loan’s specific terms.

Calculating the total interest paid over the life of a loan is crucial for understanding the true cost. This calculation, combined with a consistent repayment schedule, positively impacts your credit score, as demonstrated in this insightful article about impact of loan repayment on credit score improvement. Ultimately, a clear understanding of both the interest accrued and the positive credit impact of timely repayments is key to responsible financial management.

Handling Variable Interest Rates

Variable interest rate loans offer the potential for lower initial rates, but their total interest cost can fluctuate significantly throughout the loan term. Understanding how these fluctuations affect the total interest paid is crucial for borrowers. This section details the calculation methods, impacts, and associated risks.

Variable interest rates are tied to an index, such as the prime rate or a specific benchmark. The interest rate on the loan adjusts periodically, reflecting changes in the index. This can lead to both lower and higher payments over time.

Calculating Total Interest with Variable Rates

Calculating the total interest paid on a variable rate loan is more complex than with a fixed rate loan. Precise calculation requires tracking the interest rate at each adjustment period and applying the corresponding rate to the outstanding loan balance. Spreadsheet software or specialized financial calculators can automate this process.

Impact of Interest Rate Fluctuations

Fluctuations in interest rates directly affect the monthly payments and the overall interest cost. For instance, if the interest rate increases, the monthly payment will also increase, potentially impacting the borrower’s budget. Conversely, if the rate decreases, the monthly payment will decrease.

Examples of Variable Interest Rate Impact

Consider a $100,000 loan with a variable interest rate tied to the prime rate. Initially, the prime rate is 5%. Over the loan term, the prime rate fluctuates. In year one, it remains at 5%, resulting in a monthly payment of $X. In year two, the prime rate rises to 6%, causing the monthly payment to increase to $Y. In year three, the prime rate decreases to 4%, lowering the monthly payment to $Z. The cumulative interest paid over the entire loan term will reflect these fluctuations.

Loan Repayment with Variable Rates

A variable interest rate loan’s repayment schedule is dynamic. Changes in the interest rate directly impact the monthly payments. The longer the loan term, the greater the potential for interest rate fluctuations to affect the total interest cost. Borrowers should carefully consider their financial situation and the potential for interest rate changes before taking out a variable rate loan.

“Variable interest rate loans present both risks and rewards. Lower initial rates can lead to lower upfront costs, but unpredictable interest rate movements can increase the total interest paid over the loan term.”

Financial Implications

Understanding the financial implications of a loan is crucial for responsible borrowing. High total interest payments can significantly impact a borrower’s budget and financial well-being. Proper budgeting and effective debt management strategies are essential for mitigating these impacts and ensuring financial stability. Reducing the overall cost of borrowing is a key objective for maximizing the financial benefits of borrowing.

The financial implications of a loan extend beyond the initial borrowing amount. The total interest paid over the loan’s life can dramatically increase the overall cost, potentially impacting other financial goals. Consequently, a thorough understanding of these implications and proactive strategies to manage loan debt are vital.

Impact of High Total Interest Payments

High total interest payments can strain a borrower’s budget and reduce disposable income. This can lead to difficulty meeting other financial obligations, such as saving for the future, investing, or addressing unexpected expenses. The extra financial burden can also cause stress and anxiety, negatively affecting overall well-being.

Importance of Budgeting for Loan Payments and Interest Costs

Proper budgeting is essential for managing loan payments and interest costs effectively. A well-structured budget allows for accurate allocation of funds towards loan repayments, ensuring timely payments and avoiding late fees. It also enables the assessment of potential financial strain and allows for the creation of contingency plans for unforeseen circumstances.

Strategies for Managing Loan Debt Effectively

Effective loan debt management involves several strategies. Firstly, maintaining a consistent repayment schedule is vital to avoiding late fees and penalties. Secondly, exploring options for reducing the loan’s interest rate, such as refinancing or negotiating with the lender, can significantly lower the overall cost of borrowing. Lastly, creating a debt reduction plan, such as the snowball or avalanche methods, can accelerate the repayment process and minimize the total interest paid.

Ways to Reduce the Overall Cost of Borrowing

Several strategies can help reduce the overall cost of borrowing. One strategy is to shop around for the best loan terms, comparing interest rates, fees, and repayment options from various lenders. Another strategy is to make larger than scheduled payments whenever possible, accelerating loan repayment and reducing the accumulated interest. Lastly, considering a balance transfer credit card with a promotional 0% APR period can be a temporary solution for reducing interest costs on existing debts, but one must ensure that the promotional period is sufficient to pay off the debt before interest begins to accrue again.

Tools and Resources

Understanding loan interest calculations can be significantly aided by utilizing various tools and resources. These resources offer efficient methods for analyzing loan terms, calculating total interest, and visualizing loan repayment plans. Spreadsheet software and online calculators provide valuable support for this process.

Online Calculators

Online calculators dedicated to loan calculations are readily available and user-friendly. These tools streamline the process of determining total interest paid, simplifying complex calculations. They often allow for input of loan specifics like principal, interest rate, and loan term, and output the total interest and amortization schedule.

- Many financial websites and comparison platforms provide loan calculators. These resources are typically free and easy to use, enabling quick estimations of loan interest.

- Dedicated loan interest calculators, often found on financial websites, are specifically designed for this purpose. These calculators usually offer advanced features, allowing for customization of loan parameters.

- Mortgage calculators are specialized tools for analyzing mortgage loans, considering factors such as property value and down payment.

Using Online Calculators

To use an online loan calculator, typically you need to input several key variables. These variables include the loan amount, interest rate, loan term (in months or years), and potentially other details such as compounding frequency. After inputting these details, the calculator will provide the total interest and sometimes an amortization schedule.

Spreadsheet Software for Amortization Schedules

Spreadsheet software, such as Microsoft Excel or Google Sheets, allows for the creation of detailed amortization schedules. These schedules display the breakdown of loan payments over time, showing the principal and interest portions of each payment. Creating an amortization schedule manually can be tedious, while spreadsheet software automates the process.

Creating Amortization Schedules in Spreadsheet Software

Spreadsheet software offers formulas for calculating loan payments and the breakdown of interest and principal. Using these formulas, you can construct a table that tracks loan payments, showing the balance remaining after each payment, interest paid, and principal paid.

Example Amortization Schedule (Illustrative)

| Payment Number | Payment Amount | Interest Paid | Principal Paid | Balance Remaining |

|---|---|---|---|---|

| 1 | $1,000 | $50 | $950 | $90,500 |

| 2 | $1,000 | $49.75 | $950.25 | $90,500-950.25 = $89,549.75 |

| … | … | … | … | … |

This example illustrates a basic structure. The table shows the payment number, the payment amount, interest paid, principal paid, and the balance remaining after each payment. The amortization schedule can be extended for the complete loan term.

Online Resources

This table lists some useful online resources for loan interest calculations:

| Resource | Description |

|---|---|

| Bankrate.com | Comprehensive financial information, including loan calculators. |

| NerdWallet.com | Offers loan calculators and comparisons for various types of loans. |

| Experian.com | Provides financial resources, including calculators and tools for various credit needs. |

| Investopedia.com | A comprehensive financial resource, including loan calculation tools. |

Top FAQs: Calculating The Total Interest Paid Over The Life Of A Loan

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus accumulated interest from previous periods. This compounding effect results in a higher total interest paid over the life of a loan with compound interest.

How do variable interest rates affect total interest paid?

Variable interest rates fluctuate, meaning the interest rate on the loan can change over time. This can lead to unpredictable total interest costs, depending on the direction and magnitude of rate changes throughout the loan term.

Can I calculate total interest paid without an amortization schedule?

Yes, while amortization schedules provide a detailed breakdown, there are formulas for calculating the total interest paid directly using the loan amount, interest rate, and loan term.

What is the impact of loan term on the total interest paid?

A longer loan term generally results in higher total interest paid, as the accumulated interest over a more extended period is substantial. Conversely, shorter loan terms result in lower total interest but often require higher monthly payments.

Calculating the total interest paid over the life of a loan is crucial for understanding the true cost. However, it’s important to also consider the hidden fees associated with personal loans, which can significantly impact the overall expense. For example, fees such as origination fees, prepayment penalties, and even appraisal fees can inflate the total interest paid, which is why understanding what are the hidden fees associated with personal loans is essential for a comprehensive financial assessment.

Therefore, a thorough analysis of both the stated interest and these hidden fees is vital for accurately calculating the total interest paid over the life of a loan.

Understanding how to calculate the total interest paid over the life of a loan is crucial for responsible borrowing. However, it’s equally important to be aware of potential loan scams and predatory lending practices, which can significantly inflate the total interest paid. By researching and implementing strategies for avoiding such issues, like those detailed in strategies for avoiding loan scams and predatory lending practices , you can make more informed decisions and ensure you’re not paying excessive interest.

Ultimately, a thorough understanding of loan terms, combined with vigilance against scams, is key to minimizing the total interest paid over the life of a loan.