Secured vs. Unsecured Loans: Which One is Best for You? This guide provides a comprehensive overview of both loan types, highlighting their key differences and helping you navigate the complexities of securing the right financing for your needs. Understanding the factors that influence lender decisions, the role of collateral, and the associated risks and rewards are crucial in making an informed choice. We will delve into the specifics of each loan type, examining their application processes, interest rates, and eligibility criteria.

Different financial situations require different approaches. This analysis will aid in understanding the pros and cons of each option, empowering you to make a decision that aligns with your individual circumstances. A thorough understanding of these factors is vital to responsible borrowing and achieving financial success.

Introduction to Loans

Loans are a crucial financial tool for individuals and businesses seeking capital for various purposes, from purchasing a home to expanding a company. Understanding the different types of loans and their associated characteristics is essential for making informed financial decisions. This section provides a foundation for understanding secured and unsecured loans, highlighting their distinctions and influencing factors.

Definition of Secured and Unsecured Loans

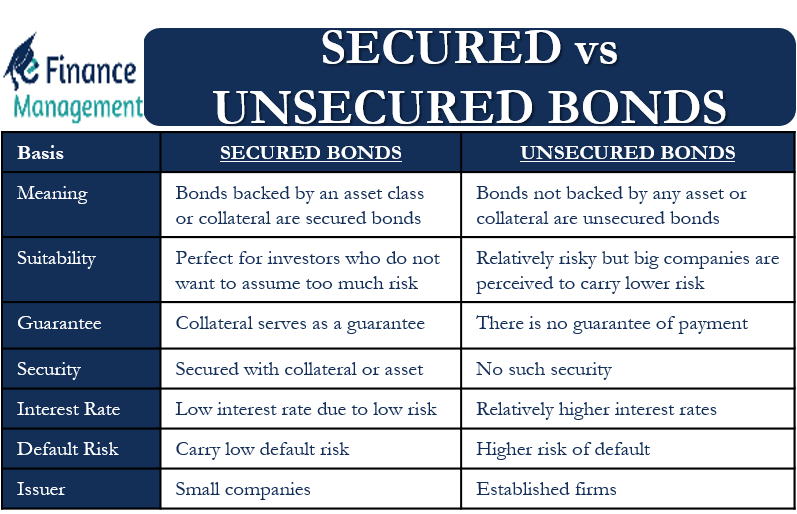

Secured loans are backed by collateral, an asset pledged as security for the loan. If the borrower defaults, the lender can seize the collateral to recover the outstanding loan amount. Conversely, unsecured loans are not backed by collateral. The lender relies on the borrower’s creditworthiness and ability to repay. This crucial difference directly impacts the interest rates, approval processes, and eligibility criteria.

Fundamental Differences between Loan Types

The core distinction between secured and unsecured loans lies in the presence or absence of collateral. This difference significantly impacts the risk assessment by lenders. Secured loans present a lower risk to the lender, allowing for potentially lower interest rates, but also requiring the borrower to pledge an asset. Unsecured loans carry a higher risk for the lender, leading to higher interest rates and stricter eligibility criteria. This difference in risk assessment directly correlates with the terms of the loan.

Factors Influencing Lender Decisions

Lenders meticulously evaluate several factors before approving a loan application. These factors include the borrower’s credit history, income, debt-to-income ratio, and employment stability. A strong credit history, consistent income, and a low debt-to-income ratio generally increase the likelihood of loan approval and favorable interest rates. Furthermore, the purpose of the loan, and the applicant’s financial goals and experience, are also considered.

Loan Comparison Table

| Loan Type | Collateral | Interest Rate | Approval Process | Eligibility Criteria |

|---|---|---|---|---|

| Secured Loan | Yes (e.g., house, car, equipment) | Generally lower | Typically faster due to lower risk | Stronger credit history, sufficient income, and asset ownership |

| Unsecured Loan | No | Generally higher | More rigorous, often requiring more documentation | Strong credit history, consistent income, and low debt-to-income ratio |

This table provides a concise overview of the key differences. The specific interest rates and eligibility criteria vary considerably based on the lender and loan terms.

Choosing between secured and unsecured loans depends heavily on your individual circumstances. A crucial factor to consider when making this decision is calculating the total interest paid over the life of a loan, which can significantly impact the overall cost. Understanding this will ultimately help you determine which loan type aligns best with your financial goals and risk tolerance.

Secured Loans

Secured loans, unlike unsecured loans, require a borrower to pledge an asset as collateral. This collateral acts as a guarantee for the lender, reducing the risk associated with the loan. Understanding the specifics of secured loans is crucial for borrowers to make informed decisions.

Collateral in Secured Loans

Collateral is a valuable asset, such as real estate or a vehicle, that a borrower pledges to a lender as security for a loan. This asset serves as a backup for the lender in case the borrower defaults on the loan. The lender can seize and sell the collateral to recover the outstanding loan amount if the borrower fails to repay the loan. This significantly reduces the lender’s risk, allowing them to offer potentially lower interest rates or more favorable loan terms compared to unsecured loans.

Types of Collateral

Various assets can serve as collateral in secured loans. Common types include:

- Real Estate: Mortgages are the most common example, where the borrower’s home serves as collateral. The lender can foreclose on the property if the borrower defaults. This type of collateral is often used for large loans like home purchases or refinancing.

- Vehicles: Auto loans are secured by the car or truck. If the borrower defaults, the lender can repossess the vehicle. This is a common option for car purchases.

- Personal Property: Items like jewelry, equipment, or other valuable assets can also be used as collateral. However, the value of the asset needs to be substantial enough to cover the loan amount and the lender’s potential costs.

Pros and Cons of Secured Loans

Secured loans offer distinct advantages and disadvantages compared to unsecured loans.

- Pros: Lower interest rates, easier loan approval process (especially for borrowers with less-than-perfect credit), and potentially larger loan amounts. The collateral reduces the risk for the lender, leading to more favorable terms.

- Cons: Risk of losing the collateral if the loan is not repaid, which can lead to financial hardship. The borrower needs to have sufficient equity or a valuable asset to act as collateral.

Situations Favoring Secured Loans

Secured loans are preferable in certain situations:

- High Loan Amounts: For significant purchases like a house, a secured loan may offer better interest rates and terms compared to an unsecured loan, particularly if the borrower has sufficient equity in an asset.

- Building Credit History: For individuals with limited or poor credit history, a secured loan can provide a chance to demonstrate responsible financial behavior. Successful repayment can positively impact future borrowing opportunities.

- Quick Funding: Secured loans often involve a faster approval process than unsecured loans, which can be beneficial for individuals needing funds quickly.

Comparison of Secured Loan Types

| Loan Type | Pros | Cons |

|---|---|---|

| Mortgage | Lower interest rates, larger loan amounts, long repayment terms | Significant financial risk if the property is lost, stringent eligibility criteria |

| Auto Loan | Potentially lower interest rates than unsecured loans, easier access to funds for vehicle purchase | Risk of repossession if the loan is not repaid, potential loss of the vehicle |

| Personal Loan Secured by Assets | Potentially favorable interest rates for high-value assets, can be useful for building credit | Risk of losing the asset if the loan is not repaid, potential loss of valuable personal property |

Unsecured Loans

Unsecured loans represent a significant portion of the loan market, offering flexibility and accessibility to borrowers. Unlike secured loans, they do not require the borrower to pledge an asset as collateral. This feature can be appealing to those who do not wish to risk losing an important possession. However, understanding the intricacies of unsecured loans, including their terms, eligibility, and potential risks, is crucial for informed decision-making.

Unsecured loans operate on the principle of trust and creditworthiness. Lenders assess a borrower’s financial history, income, and credit score to determine their ability to repay the loan. This assessment process varies among lenders, and borrowers should compare offerings to find the most suitable terms. Factors such as loan amount, repayment period, and interest rates significantly influence the overall cost of borrowing.

How Unsecured Loans Work

Unsecured loans function by relying on the borrower’s creditworthiness as the primary guarantee of repayment. Lenders evaluate a borrower’s credit history, income, and debt-to-income ratio to determine the risk associated with the loan. If approved, the borrower receives the loan amount directly, without needing to provide any collateral. Repayment typically involves fixed monthly installments, covering both principal and interest.

Types of Unsecured Loans

A variety of unsecured loans are available to cater to diverse financial needs. Examples include:

- Personal Loans: These loans can be used for a wide range of purposes, such as debt consolidation, home improvements, or major purchases. The loan amount, repayment terms, and interest rate depend on the borrower’s creditworthiness and the lender’s terms.

- Credit Cards: Credit cards are a common form of unsecured loan, offering revolving credit that can be used for various transactions. Borrowers can access funds up to a predetermined credit limit and repay them over time, often with fluctuating interest rates.

- Student Loans: These loans are specifically designed to help students finance their education. Eligibility and interest rates are often determined by the student’s academic performance and financial need.

- Lines of Credit: These loans provide access to a predetermined amount of funds, allowing borrowers to borrow as needed within the credit limit. Interest is usually charged on the outstanding balance.

Eligibility Criteria for Unsecured Loans

Lenders employ specific criteria to assess a borrower’s eligibility for unsecured loans. These criteria typically include:

- Credit Score: A higher credit score generally indicates a lower risk to the lender, leading to better loan terms. Lenders often consider scores above 660 to be favorable for unsecured loans.

- Income: Lenders evaluate a borrower’s income stability and capacity to repay the loan. Consistent and sufficient income is crucial for securing an unsecured loan.

- Debt-to-Income Ratio (DTI): The DTI ratio compares a borrower’s total monthly debt obligations to their monthly income. A lower DTI ratio indicates a lower risk to the lender.

- Length of Credit History: A longer and stable credit history demonstrates responsible financial management and strengthens a borrower’s application.

Interest Rates of Secured vs. Unsecured Loans

Unsecured loans typically carry higher interest rates compared to secured loans. This is because lenders perceive unsecured loans as riskier due to the lack of collateral. Interest rates for unsecured loans are influenced by factors like the borrower’s creditworthiness, the loan amount, and the prevailing market conditions. For instance, a borrower with a lower credit score might face higher interest rates than one with a higher score.

Risks Associated with Unsecured Loans

Unsecured loans involve certain risks for borrowers. Higher interest rates can increase the overall cost of borrowing. Failure to meet repayment obligations can damage a borrower’s credit score and result in collection actions. Borrowers should carefully evaluate their ability to repay the loan before committing to an unsecured loan. Thorough research and comparison of different lenders and loan terms are essential to minimize these risks.

Loan Application Process

The loan application process varies significantly between secured and unsecured loans, impacting the time it takes to secure funding. Understanding these differences is crucial for borrowers to make informed decisions aligned with their financial situations and goals. The application process, from initial inquiry to final approval, can be streamlined with a clear understanding of the requirements and expectations for each loan type.

The application process for both secured and unsecured loans involves a series of steps, each designed to assess the borrower’s creditworthiness and ability to repay the loan. A thorough understanding of these steps can help borrowers navigate the process effectively and increase their chances of loan approval.

Secured Loan Application Steps

The application process for a secured loan typically involves several steps. A crucial first step involves providing collateral, which is a tangible asset like a house or vehicle. The lender will assess the value of the collateral to determine the loan amount. This process ensures the lender has recourse if the borrower defaults.

- Collateral Appraisal: The lender evaluates the value of the offered collateral to determine the loan amount and terms. A professional appraisal ensures the asset’s worth is accurately reflected, preventing inflated loan amounts. For example, a lender appraising a car as collateral will consider the car’s make, model, year, condition, and market value to determine the appropriate loan amount.

- Loan Application Form: Completing the loan application form accurately and providing all necessary documentation, including proof of income and employment history, is vital for a smooth process. Accurate information ensures the lender has a clear picture of the borrower’s financial capacity.

- Credit Check: A thorough credit check assesses the borrower’s credit history, including payment patterns, outstanding debts, and credit utilization. A good credit history is typically required for a secured loan, but not always a pre-requisite.

- Documentation Submission: Submitting all required documentation, such as income statements, tax returns, and proof of address, verifies the borrower’s financial standing and confirms their identity.

- Loan Approval/Disbursement: Upon successful verification of the application, the lender approves the loan and releases the funds to the borrower.

Unsecured Loan Application Steps

Unlike secured loans, unsecured loans don’t require collateral. Lenders rely heavily on the borrower’s creditworthiness and ability to repay.

- Loan Application Form: Completing the loan application form with accurate information about the borrower’s financial history, including employment details, income, and debts is essential.

- Credit Check: The credit check is paramount. Lenders scrutinize credit history to assess the borrower’s reliability and ability to repay the loan. A higher credit score typically translates to better loan terms and approval chances.

- Verification of Information: The lender verifies the information provided by the borrower to ensure accuracy and assess the borrower’s financial capacity.

- Loan Approval/Disbursement: A positive outcome of the verification process results in loan approval, and the funds are disbursed to the borrower.

Comparison of Timeframes

The time required for loan approval can differ substantially between secured and unsecured loans. Secured loans, due to the collateral verification process, often take longer for approval than unsecured loans. The appraisal of collateral and verification processes can extend the timeframe.

| Loan Type | Typical Timeframe | Factors Affecting Timeframe |

|---|---|---|

| Secured Loan | 2-6 weeks | Collateral appraisal, credit check, documentation verification |

| Unsecured Loan | 1-4 weeks | Credit check, verification of income and employment |

Credit Score Impact

A strong credit score significantly impacts loan approval chances for both secured and unsecured loans. A higher credit score usually translates to more favorable loan terms, including lower interest rates and increased loan amounts.

- Secured Loans: While collateral reduces reliance on credit score, a strong score can lead to better terms and potentially faster approvals.

- Unsecured Loans: A higher credit score is paramount for securing favorable loan terms and approval chances, as lenders heavily rely on the borrower’s credit history for risk assessment.

Interest Rates and Repayment Terms

Understanding the interest rates and repayment terms associated with loans is crucial for making informed financial decisions. Choosing the right loan type hinges on factors such as the prevailing market conditions, your financial situation, and the specific terms offered by lenders.

Interest rates, essentially the cost of borrowing, are influenced by a complex interplay of factors. These factors vary for secured and unsecured loans, impacting the overall borrowing experience.

Factors Influencing Interest Rates

Interest rates are determined by a multitude of interconnected factors. These factors affect both secured and unsecured loans, but their relative impact differs. Key influences include the prevailing economic climate, the creditworthiness of the borrower, the type of loan, and the loan amount. Market conditions, like inflation and economic growth, significantly affect the overall cost of borrowing. A strong economy may lead to lower rates, while a weaker economy often results in higher rates. The borrower’s credit score is paramount; a higher score generally translates to lower interest rates. The type of loan, whether secured or unsecured, directly impacts the risk assessment by lenders. Lastly, the amount borrowed influences the interest rate, with larger sums typically incurring higher rates.

Comparison of Interest Rates for Secured and Unsecured Loans

Secured loans, often backed by collateral, typically command lower interest rates compared to unsecured loans. This is because the collateral reduces the lender’s risk, making the loan less risky. However, the borrower forfeits the collateral if the loan isn’t repaid. Unsecured loans, lacking collateral, carry a higher interest rate to compensate for the increased risk to the lender. The difference in interest rates can be substantial, reflecting the varying levels of risk involved. For instance, a personal loan (unsecured) might have a rate of 10%, whereas a mortgage (secured) might have a rate of 6%.

Fixed and Variable Interest Rates

Loan interest rates can be either fixed or variable. A fixed interest rate remains constant throughout the loan term, offering borrowers predictability and stability. This type of loan allows for easier budgeting and planning. In contrast, a variable interest rate fluctuates based on prevailing market conditions. While variable rates can initially be lower, they may increase over time if market conditions change. This uncertainty necessitates careful consideration by borrowers.

Repayment Options for Loans

Lenders offer various repayment options to suit different borrower needs. Common repayment structures include fixed monthly payments, balloon payments (a large payment at the end of the loan term), and interest-only payments (paying only interest for a specified period). Each option has its own implications for the borrower’s financial obligations. Understanding these options is critical for aligning repayment plans with personal financial circumstances.

Table of Repayment Terms

| Loan Type | Repayment Period | Interest Rate (Example) |

|---|---|---|

| Mortgage | 15-30 years | 6-8% |

| Auto Loan | 3-7 years | 5-8% |

| Personal Loan (Unsecured) | 1-5 years | 8-12% |

| Student Loan | 10-25 years | 4-7% |

Note: Interest rates are examples and can vary significantly based on factors such as creditworthiness and market conditions.

Eligibility Criteria: Secured Vs. Unsecured Loans: Which One Is Best For You?

Loan eligibility is a crucial factor for borrowers, as it determines their access to funds. Lenders meticulously evaluate applicants to assess their ability to repay the loan, mitigating potential financial risks. This evaluation process considers various factors, including credit history, income stability, and existing debt levels. Understanding these criteria is essential for borrowers to increase their chances of loan approval.

Credit Scores, Secured vs. Unsecured Loans: Which One is Best for You?

Credit scores serve as a critical indicator of an individual’s creditworthiness. These scores reflect a borrower’s history of repaying debts, demonstrating their reliability and responsibility. Lenders use credit scores to gauge the likelihood of timely repayment and assess the overall risk associated with granting a loan. Higher credit scores typically translate to better loan terms and lower interest rates. For example, a borrower with a credit score of 750 or higher might qualify for a lower interest rate on an unsecured loan compared to a borrower with a credit score below 650.

Income and Debt-to-Income Ratio

Lenders assess an applicant’s income stability to determine their ability to make timely loan repayments. A consistent and sufficient income stream demonstrates a borrower’s capacity to manage financial obligations. The debt-to-income (DTI) ratio is another critical factor. This ratio measures the proportion of a borrower’s monthly debt payments to their monthly gross income. A lower DTI ratio typically signifies a better ability to handle additional debt, increasing the likelihood of loan approval. For instance, a borrower with a low DTI ratio of 30% might be more likely to be approved for a loan than someone with a higher DTI ratio of 50%.

Secured vs. Unsecured Loan Eligibility

Secured loans, backed by collateral, often have less stringent eligibility requirements compared to unsecured loans. The presence of collateral reduces the lender’s risk, allowing them to approve loans for borrowers with potentially lower credit scores or incomes. Unsecured loans, conversely, require a stronger credit history and higher income to demonstrate the borrower’s ability to repay without collateral. The lender must ensure the borrower has sufficient capacity to manage both existing and future debt obligations.

Loan Application Documentation

The documentation required for each loan type varies. Secured loans typically necessitate documentation related to the collateral, such as proof of ownership and valuation. This process helps lenders assess the collateral’s worth and value to secure the loan. Unsecured loans, on the other hand, require documentation that validates the borrower’s income and credit history. This may include pay stubs, tax returns, and bank statements. The specific documents needed can vary based on lender policies and loan terms.

- Secured Loans: These loans require documentation pertaining to the value and ownership of the collateral. This includes, but is not limited to, title deeds, appraisals, and property valuation reports.

- Unsecured Loans: These loans require documentation verifying the borrower’s income and creditworthiness. Typical documents include pay stubs, tax returns, bank statements, and credit reports.

Risks and Rewards

Understanding the potential risks and rewards associated with secured and unsecured loans is crucial for making informed financial decisions. A careful evaluation of these factors can help borrowers choose the loan type that best aligns with their financial situation and goals. Weighing the advantages against the disadvantages will empower individuals to make responsible choices.

Loan choices are often influenced by personal circumstances and financial standing. Borrowers should assess their ability to repay the loan and the potential impact on their financial well-being. This involves considering the associated interest rates, repayment terms, and any collateral requirements.

Potential Risks of Secured Loans

The primary risk associated with secured loans is the potential loss of the collateral if the borrower defaults on the loan. This collateral, which could be a house, car, or other valuable asset, is pledged as security for the loan. If the borrower fails to meet the repayment obligations, the lender has the legal right to seize and sell the collateral to recover the outstanding loan amount. This can result in significant financial hardship for the borrower. For example, a homeowner who defaults on a mortgage loan risks losing their home.

Potential Risks of Unsecured Loans

Unsecured loans, lacking collateral, pose a higher risk for lenders. Lenders rely on the borrower’s creditworthiness and ability to repay. If the borrower defaults, the lender may not be able to recover the full amount of the loan. This risk is mitigated by factors such as the borrower’s credit score and repayment history. Higher risk translates to higher interest rates. For instance, a borrower with a poor credit history might face significantly higher interest rates on an unsecured loan.

Potential Rewards of Secured Loans

Secured loans typically offer lower interest rates compared to unsecured loans. This is because the lender has a tangible asset as security, reducing their risk. Borrowers with strong credit histories or those seeking larger loan amounts often find secured loans more advantageous. This is because the security provided allows for more favorable terms, including potentially lower interest rates and easier loan approval.

Potential Rewards of Unsecured Loans

Unsecured loans often provide greater flexibility and convenience, as they do not require the borrower to pledge an asset as collateral. This can be beneficial for individuals who wish to avoid the risk of losing an asset or who may not have suitable assets to pledge. For instance, a borrower needing a small loan for an emergency might find an unsecured loan more convenient than a secured one.

Loan Defaults and Consequences

Loan defaults occur when a borrower fails to make scheduled payments on their loan. This can lead to various consequences, including damage to the borrower’s credit score, potential legal action by the lender, and, in the case of secured loans, the loss of the collateral. The consequences can be substantial, affecting future borrowing opportunities and overall financial stability. For example, a borrower who defaults on a loan may have difficulty obtaining future loans or credit lines due to a damaged credit history.

Choosing the Right Loan

Deciding between a secured and unsecured loan hinges on careful consideration of your individual financial situation and borrowing goals. Understanding the potential benefits and drawbacks of each loan type is crucial to making an informed decision. A clear understanding of your needs and circumstances will guide you toward the loan type that best suits your financial aspirations.

Careful evaluation of factors like credit score, loan amount, and repayment timeframe is essential to selecting the most advantageous loan option. The subsequent sections provide a framework to help you navigate this decision-making process, emphasizing the considerations necessary for a successful loan selection.

Factors to Consider

Understanding the distinguishing characteristics of secured and unsecured loans is paramount in choosing the right one. Key factors include creditworthiness, loan amount, and repayment capacity. This section Artikels the critical aspects to weigh when making your choice.

- Creditworthiness: A strong credit history often translates to favorable interest rates on unsecured loans. Conversely, those with less-than-stellar credit may find secured loans a more accessible option, offering a path to building credit.

- Loan Amount: Large loan amounts may be easier to secure with a secured loan, leveraging the collateral as a guarantee. Unsecured loans are more suitable for smaller sums, often for immediate needs or short-term financial goals.

- Repayment Capacity: Assessing your ability to repay the loan is crucial. Consider the loan’s term, interest rate, and monthly payment obligations to ensure the chosen loan aligns with your financial capabilities.

Flowchart for Loan Selection

This flowchart provides a visual guide to help you determine the best loan type for your situation. It guides you through the process, considering various factors and ultimately arriving at a suitable choice.

(Imagine a flowchart with decision points: High Credit Score? Yes/No; Loan Amount Large? Yes/No; Repayment Capacity High? Yes/No. Each path leads to either a Secured Loan or Unsecured Loan recommendation. The flowchart should incorporate the previous points.)

Situations Favoring Secured Loans

Secured loans, leveraging collateral, are often preferred in specific circumstances.

- Building or Establishing Credit: Individuals with limited or no credit history might find secured loans a suitable option to build creditworthiness and demonstrate responsible financial management. Successfully managing a secured loan can positively impact future credit applications.

- Large Loan Amounts: Obtaining substantial sums, often for major purchases like homes or businesses, can often be more attainable with a secured loan. The collateral acts as a tangible guarantee for lenders.

- Lower Interest Rates on Specific Loans: Certain secured loans, such as mortgages, might offer lower interest rates compared to unsecured loans due to the higher security for the lender. This can translate into significant savings over the life of the loan.

Situations Favoring Unsecured Loans

Unsecured loans, devoid of collateral requirements, present advantages in certain scenarios.

- Small Loan Amounts: Unsecured loans are well-suited for smaller financial needs, such as personal expenses or short-term investments. The simplicity and speed of application often make them preferable in these cases.

- Strong Credit History: Individuals with excellent credit scores often benefit from lower interest rates on unsecured loans, leading to more favorable repayment terms.

- Flexibility and Speed of Access: Unsecured loans often offer a faster application process, enabling quick access to funds. This can be crucial for immediate financial requirements.

Loan Alternatives

Exploring financing options beyond traditional loans can be beneficial for various reasons. Borrowing isn’t always the best solution, and understanding alternative avenues can help individuals and businesses make informed decisions. Alternative financing methods often come with different terms, risks, and rewards, and careful consideration is key.

Alternative financing options provide a diverse range of approaches to securing capital. They can be particularly useful for those who may not qualify for traditional loans or who prefer a different structure for their funding. These methods can be tailored to specific needs and circumstances, offering flexible terms and conditions.

Alternative Financing Methods

A wide array of alternative financing methods exist, each with its own characteristics. These alternatives can often offer unique advantages over traditional loans.

- Crowdfunding: This involves raising capital by soliciting small contributions from a large number of people, typically through online platforms. It can be an effective way to raise funds for projects, businesses, or personal needs. Examples include Kickstarter and Indiegogo, which allow individuals and entrepreneurs to present their projects and solicit funds from the public. This method is suitable for projects with a clear value proposition and a passionate community of supporters.

- Venture Capital and Angel Investors: For startups and businesses seeking substantial capital, venture capital and angel investors can provide funding in exchange for equity in the company. This approach allows for significant funding but comes with the understanding that the investor gains ownership in the business. This funding method is often used by companies seeking substantial investment for expansion or innovation.

- Peer-to-Peer Lending: Platforms connect borrowers directly with lenders, eliminating traditional financial institutions. Borrowers can often find more competitive interest rates than through banks, while lenders receive returns based on the borrower’s creditworthiness. This model offers an alternative to traditional lending channels. Platforms like LendingClub and Prosper facilitate this process.

- Grants: Grants are non-repayable funds offered by organizations for specific purposes. They can be a great source of funding for projects aligned with the grant’s mission. Examples include grants from government agencies, foundations, and corporations. The application process for grants usually involves detailed proposals outlining the project and its alignment with the grant’s objectives.

- Factoring: This involves selling outstanding invoices to a third party for immediate cash. It is a method to address short-term cash flow needs. This method often works well for businesses with consistent and reliable invoices. This is an effective way for companies to accelerate cash flow and address immediate financial needs.

- Lines of Credit: A line of credit is a pre-approved amount of credit that can be accessed as needed. This is a useful alternative to a traditional loan for those who may need to access funds periodically. These are often used for working capital or business expenses. A line of credit offers flexibility and a pre-approved amount, which can be valuable for managing cash flow needs.

Comparison of Loan Alternatives

Comparing loans to other financing options involves considering factors like cost, flexibility, and risk.

| Financing Option | Cost | Flexibility | Risk |

|---|---|---|---|

| Traditional Loans | Interest rates and fees | Generally fixed terms | Creditworthiness is crucial |

| Crowdfunding | Platform fees | Highly flexible | Success depends on project appeal |

| Venture Capital/Angel Investors | Equity stake | Variable terms | Loss of ownership/control |

| Peer-to-Peer Lending | Interest rates | Flexible terms | Creditworthiness is crucial |

| Grants | None (repayable) | Very flexible | Competitive application process |

| Factoring | Fees and discounts | Quick access to funds | Loss of control over invoice |

| Lines of Credit | Interest rates and fees | Access funds as needed | Creditworthiness is crucial |

Responsible Borrowing Practices

Responsible borrowing is crucial for financial well-being. Understanding the implications of borrowing, and proactively managing loan obligations, is essential to avoid potential financial hardship. Taking calculated steps to manage loan repayments and avoiding over-indebtedness safeguards your financial future.

Responsible borrowing involves more than just securing a loan; it’s about thoughtfully considering your financial capacity and making informed decisions to ensure timely repayment. Failure to do so can have serious consequences, including damage to your credit score and potential legal issues.

Importance of Prudent Borrowing Habits

Sound borrowing habits are vital for maintaining financial stability. Borrowing responsibly ensures that you can meet your financial obligations without compromising other essential aspects of your life, like savings, investments, or emergency funds. Prudent borrowing practices also help build a strong credit history, which is valuable for future financial opportunities.

Steps to Avoid Loan Defaults

Consistent and timely repayments are key to avoiding loan defaults. Develop a clear repayment plan, factoring in your income and expenses. Budgeting effectively to allocate funds for loan repayments is essential. A well-defined repayment plan, combined with careful budgeting, significantly reduces the risk of default.

- Establish a realistic budget: Thoroughly analyze your income and expenses to determine how much you can comfortably allocate to loan repayments without jeopardizing other financial needs. Understanding your financial situation allows you to develop a plan that works within your means.

- Create a repayment schedule: Develop a detailed repayment schedule that aligns with your loan terms. This schedule should be meticulously tracked to ensure that payments are made on time and in full. By establishing a clear schedule, you can avoid confusion and missed payments.

- Monitor your financial health: Regularly track your income, expenses, and loan repayments to stay informed about your financial situation. This allows you to make necessary adjustments to your budget or repayment plan if needed. Regular monitoring provides crucial insights into your financial well-being.

- Seek professional guidance if needed: If you are struggling to manage your loan repayments, don’t hesitate to seek advice from a financial advisor or credit counselor. They can offer guidance and strategies to help you navigate financial difficulties.

Implications of Over-Indebtedness

Over-indebtedness can have far-reaching consequences. It can severely impact your financial stability, affecting your ability to save, invest, or handle unexpected expenses. Over-indebtedness can negatively affect your credit score, making it difficult to secure loans or credit in the future.

- Impact on Credit Score: Repeated missed payments or defaults significantly damage your credit score, making it harder to secure loans, credit cards, or even rent an apartment. This reduced creditworthiness can have long-term financial repercussions.

- Increased Financial Stress: The constant pressure of multiple loan repayments and the fear of default can lead to significant financial stress. This stress can impact your mental and physical well-being.

- Legal Consequences: Failure to meet loan obligations can result in legal action, including lawsuits and potential wage garnishment. This can be a serious consequence for your personal and professional life.

Illustrative Examples

Understanding the application and repayment processes of secured and unsecured loans can be facilitated by reviewing practical examples. These examples highlight the key factors involved in securing and managing these different types of loans.

Successful Secured Loan Application

A scenario illustrating a successful secured loan application involves a homeowner, Maria, seeking a loan for home renovations. Maria owns a property with a clear title and a strong credit history. She provides the property as collateral for the loan, demonstrating a low risk profile to the lender. The lender assesses the value of the property, evaluates Maria’s creditworthiness, and approves the loan amount based on the collateral’s value. A pre-approval process may have been conducted, enabling Maria to have a better understanding of the loan terms and conditions before applying.

Successful Unsecured Loan Application

A successful unsecured loan application is demonstrated by David, a professional with a stable income and a good credit history. David has no significant debt and his credit report reflects responsible financial management. The lender assesses David’s credit score, income, and debt-to-income ratio, finding them suitable for an unsecured loan. A lower interest rate is typically offered compared to a secured loan due to the reduced risk for the lender.

Loan Repayment Schedule Example

A detailed example of a loan repayment schedule is presented below, showcasing the typical structure of a loan repayment plan. This schedule demonstrates how the borrower’s monthly payments are allocated to cover both interest and principal. The structure of the schedule varies based on the specific loan terms.

| Month | Payment Amount | Interest Paid | Principal Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,000 | $50 | $950 | $19,050 |

| 2 | $1,000 | $49.80 | $950.20 | $18,100 |

| 3 | $1,000 | $49.50 | $950.50 | $17,150 |

| … | … | … | … | … |

| 60 | $1,000 | $2.50 | $997.50 | $0 |

This loan repayment schedule assumes a fixed monthly payment of $1,000 over a 60-month period for a $20,000 loan. The interest portion of the payment is calculated using a standard interest rate, decreasing gradually as the principal amount is reduced.

Helpful Answers

What are the common documentation requirements for secured loans?

Documentation requirements for secured loans typically include proof of ownership of the collateral (e.g., title for a vehicle, deed for real estate), income verification, and identification documents.

How does a credit score impact loan approval chances?

A higher credit score generally increases the likelihood of loan approval and often results in more favorable interest rates for both secured and unsecured loans.

What are some alternatives to traditional loans?

Alternative financing options include crowdfunding platforms, peer-to-peer lending, and government-backed programs. These options may offer different terms and conditions.

What are the potential risks associated with unsecured loans?

Unsecured loans often carry a higher interest rate compared to secured loans due to the increased risk for the lender. Borrowers should carefully consider their ability to repay the loan before taking out an unsecured loan.

Understanding the differences between secured and unsecured loans is crucial for making informed financial decisions. However, it’s equally important to be aware of potential loan scams and predatory lending practices, such as those outlined in strategies for avoiding loan scams and predatory lending practices. By carefully researching lenders and loan terms, and employing these preventative measures, you can better assess the risks associated with each loan type and choose the option that best suits your individual needs.

Choosing between secured and unsecured loans hinges on various factors, including your creditworthiness and financial goals. Understanding the impact of loan repayment on your credit score improvement is crucial in this decision-making process. For example, consistently repaying your loan on time, as detailed in impact of loan repayment on credit score improvement , significantly strengthens your credit history, ultimately influencing your eligibility for future financial products.

Ultimately, the best choice for you depends on your individual circumstances and credit history.

Choosing between secured and unsecured loans can be a crucial financial decision. Understanding the nuances of each option is key, and loan.ruangbimbel.co.id provides valuable insights into the factors to consider. Ultimately, the best loan type depends on individual circumstances and financial goals.