The role of credit reports and scores in loan approval process is crucial in determining a borrower’s creditworthiness. This comprehensive overview explores the intricate steps involved, from initial application to final approval or rejection, highlighting the impact of credit reports and scores at each stage. It delves into various factors, including credit history length, payment history, and outstanding debts, and how they influence loan terms and interest rates.

Understanding the nuances of credit assessment is vital for both lenders and borrowers. This exploration reveals the importance of credit reports and scores in a transparent and impartial way, enabling a better understanding of the loan approval process.

Introduction to Credit Reports and Scores

Credit reports and scores are fundamental components of the modern financial system. They provide a concise summary of an individual’s credit history, detailing borrowing and repayment patterns. This information is crucial for lenders to assess the risk associated with granting loans or extending credit. A positive credit history, reflected in a favorable credit score, often translates to better loan terms and lower interest rates. Conversely, a poor credit history can make it more challenging to secure favorable financing options.

The significance of credit reports and scores extends beyond individual borrowers. These reports form the basis for informed lending decisions, enabling financial institutions to manage risk effectively. Accurate credit information contributes to a more stable and transparent financial market. Credit reports and scores, therefore, play a pivotal role in the overall health and functioning of the financial industry.

Factors Influencing Credit Scores

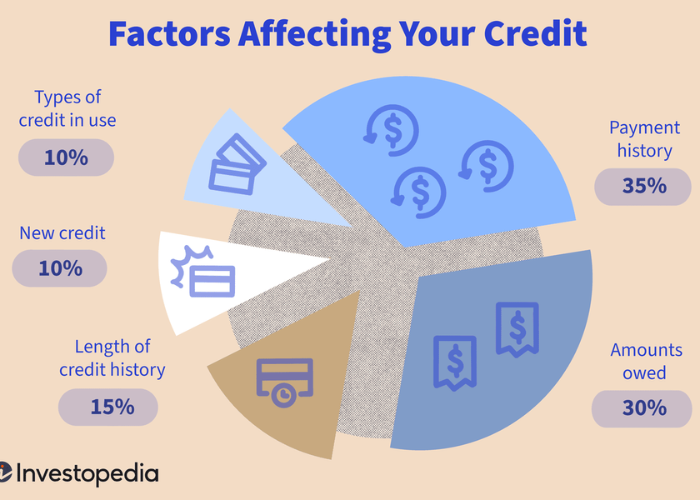

Credit scores are multifaceted assessments, reflecting various aspects of an individual’s credit history. Several factors contribute to the calculation of these scores, influencing the likelihood of loan approval and the associated interest rates. These factors provide a comprehensive picture of a borrower’s creditworthiness.

- Payment History: Consistent on-time payments demonstrate responsible financial management and significantly contribute to a higher credit score. Late payments, on the other hand, negatively impact the score and indicate potential credit risk.

- Amounts Owed: The proportion of available credit utilized plays a vital role in credit scoring. Maintaining a low credit utilization ratio (the amount of credit used relative to the total available credit) is generally favorable, as it suggests responsible borrowing practices.

- Length of Credit History: A longer credit history provides a more comprehensive view of a borrower’s borrowing and repayment habits, allowing lenders to assess the consistency of their credit management over time. A longer history generally contributes positively to the credit score.

- New Credit: Frequent applications for new credit can signal a higher risk of default. Lenders assess the frequency and nature of new credit applications when evaluating creditworthiness.

- Types of Credit: A diverse credit mix, including various types of credit (e.g., credit cards, loans, mortgages), is often considered a positive indicator of creditworthiness.

Comparison of Credit Bureaus

Different credit bureaus (Equifax, Experian, and TransUnion) employ distinct methodologies in compiling credit reports and calculating credit scores. This variation necessitates understanding the nuances of each bureau’s approach.

| Credit Bureau | Reporting Criteria | Scoring Models | Typical Score Range |

|---|---|---|---|

| Equifax | Includes information on payment history, amounts owed, length of credit history, new credit, and types of credit. | Employs a proprietary scoring model, incorporating various factors and weights. | Typically between 300 and 850. |

| Experian | Similar to Equifax, encompassing payment history, amounts owed, credit history length, new credit, and types of credit. | Utilizes a unique scoring model that considers the same factors as Equifax, but with different weighting schemes. | Generally between 300 and 850. |

| TransUnion | Covers payment history, amounts owed, credit history length, new credit, and credit mix, among other factors. | Employs a proprietary scoring algorithm, taking into account various factors and weights, similar to the other two bureaus. | Typically between 300 and 850. |

Loan Approval Process Overview

The loan application process, while seemingly straightforward, involves a series of critical steps. Understanding these steps and the role credit reports and scores play throughout is essential for both applicants and lenders. A well-defined process ensures a fair and efficient evaluation of loan applications, ultimately contributing to responsible lending practices.

Key Steps in a Loan Application

The loan approval process typically follows a structured path, beginning with the initial application and culminating in either approval or rejection. This methodical approach allows lenders to thoroughly assess the applicant’s financial stability and creditworthiness.

- Application Submission: The applicant initiates the process by submitting a loan application, providing necessary personal and financial information. This initial step establishes the applicant’s intent and sets the stage for further evaluation. A well-structured application ensures the lender has the relevant information to begin the assessment.

- Preliminary Evaluation: Lenders conduct a preliminary review of the application, verifying the completeness and accuracy of the submitted data. This step involves checks for consistency and potential inconsistencies in the information provided. If any inconsistencies are found, the applicant may be asked to provide further clarification.

- Credit Report and Score Retrieval: Lenders obtain the applicant’s credit report from credit bureaus, such as Equifax, Experian, or TransUnion. This report provides a detailed history of the applicant’s credit behavior, including payment history, outstanding debts, and credit utilization. The credit score, a numerical representation of this creditworthiness, is derived from this report. This is a crucial step, as credit history is a significant indicator of future repayment potential.

- Debt-to-Income Ratio Analysis: Lenders calculate the applicant’s debt-to-income ratio (DTI), which represents the proportion of their income dedicated to debt payments. A lower DTI suggests a greater capacity to manage loan obligations. This analysis, alongside the credit report, provides a comprehensive picture of the applicant’s financial responsibility.

- Loan Officer Review: The loan officer thoroughly reviews the application, credit report, and supporting documentation. This step ensures all factors are considered, and potential risks are identified and mitigated. The loan officer assesses the applicant’s ability to meet the loan terms, taking into account both financial and personal factors.

- Loan Approval/Rejection: Based on the assessment of various factors, including the credit report and score, the lender makes a final decision. If approved, the loan terms and conditions are Artikeld. If rejected, the reasons are usually provided. The transparency and rationale behind the decision are essential for maintaining trust in the lending process.

Credit Report and Score Influence

Credit reports and scores play a pivotal role in each stage of the loan approval process. These reports provide lenders with a comprehensive view of the applicant’s credit history, allowing them to assess risk and determine the appropriate loan terms.

- Application Submission: While not directly impacting the initial application, it sets the stage for a thorough evaluation. The applicant’s credit history and score provide insights into their overall financial responsibility, impacting the likelihood of a positive outcome.

- Preliminary Evaluation: The initial review considers the application’s completeness and consistency. Credit history and score are not yet directly factored in but lay the groundwork for further scrutiny.

- Credit Report and Score Retrieval: This is the most significant stage for credit reports and scores. The report and score directly influence the assessment of risk. Strong credit scores and positive payment histories demonstrate responsible financial management, which positively influences the evaluation.

- Debt-to-Income Ratio Analysis: The DTI, alongside the credit report and score, further illustrates the applicant’s financial stability. A strong credit history and score can often mitigate concerns related to a high DTI.

- Loan Officer Review: During this step, the credit report and score are heavily weighted in the final decision. A favorable credit history and score often result in more favorable loan terms and approval.

- Loan Approval/Rejection: Credit reports and scores are the ultimate determinant in the approval/rejection process. A poor credit history or score often results in rejection, whereas a strong credit profile usually leads to approval with favorable terms.

Weighting of Factors in Loan Evaluation

The following table demonstrates the relative weight assigned to various factors in the loan evaluation process. Credit score, while not the sole determinant, is a significant factor in determining the final decision.

| Factor | Weighting (Illustrative) |

|---|---|

| Credit Score | High (e.g., 40%) |

| Debt-to-Income Ratio (DTI) | Medium (e.g., 30%) |

| Loan Amount | Medium (e.g., 15%) |

| Loan Purpose | Low (e.g., 5%) |

| Employment History | Medium (e.g., 10%) |

| Collateral (if applicable) | Variable |

Note: The weighting of factors may vary between lenders and loan types.

Role of Credit Reports in Loan Decisions

Credit reports are fundamental tools for lenders in evaluating loan applications. They provide a comprehensive snapshot of a borrower’s credit history, enabling lenders to assess the risk associated with extending credit. This assessment is crucial for making informed decisions and mitigating potential financial losses. The information contained within these reports allows lenders to predict a borrower’s likelihood of repaying the loan, a key element in the loan approval process.

Lenders meticulously analyze the details presented in credit reports to determine the borrower’s creditworthiness. This evaluation encompasses various aspects of the borrower’s financial responsibility, including repayment patterns, outstanding debts, and credit utilization. The depth and accuracy of this assessment are essential for both the lender and the borrower. By understanding the specifics of a borrower’s credit history, lenders can make prudent decisions, while borrowers can gain insights into their credit standing and make necessary adjustments to improve their financial profile.

Specific Information Influencing Loan Decisions

Credit reports contain a wealth of information that significantly influences loan decisions. Key details include payment history, outstanding debts, credit utilization, length of credit history, and types of credit accounts held. These factors, when evaluated collectively, offer a comprehensive picture of the borrower’s financial responsibility.

- Payment History: This section details the borrower’s record of on-time and late payments. A consistent history of timely payments indicates a responsible borrower, whereas a pattern of late or missed payments suggests a higher risk. Lenders often scrutinize the frequency and severity of late payments to gauge the borrower’s ability to manage financial obligations. For example, a borrower with a consistent history of late payments on credit cards may face increased difficulty obtaining a mortgage loan, as the lender will view them as a higher-risk borrower.

- Outstanding Debts: The total amount of outstanding debts, including credit card balances, loans, and other financial obligations, plays a significant role. A high level of outstanding debt relative to income suggests a higher risk, while a low level of debt often indicates a lower risk. Lenders carefully consider the proportion of outstanding debt to the borrower’s income to assess their capacity to repay additional debt.

- Credit Utilization: This metric reflects the proportion of available credit that the borrower is currently using. A low credit utilization ratio (e.g., using less than 30% of available credit) suggests a lower risk, whereas a high ratio (e.g., using over 50% of available credit) suggests a higher risk. Lenders prefer borrowers with a lower credit utilization rate as it indicates a greater ability to manage credit responsibly.

- Length of Credit History: A longer credit history provides lenders with a more comprehensive view of the borrower’s financial behavior over time. A longer history allows lenders to assess the consistency of the borrower’s payment habits and financial management. This is important as it helps predict future behavior and assess the borrower’s long-term financial stability. A shorter history may lead to a higher risk assessment for the lender. For example, a recent college graduate with only a few credit accounts might be viewed with greater caution than a borrower with a 10-year history of responsible credit management.

- Types of Credit Accounts: The types of credit accounts held by the borrower, such as credit cards, installment loans, and mortgages, provide additional insights into their financial activities. A diversified portfolio of accounts can suggest a more comprehensive understanding of credit management. The mix of credit types and the corresponding payment history can influence the overall risk assessment.

Loan Type and Credit Report Analysis

Different types of loans employ varying degrees of scrutiny when evaluating credit reports. For example, mortgages often require a more in-depth analysis of credit history and debt levels compared to smaller personal loans.

| Loan Type | Focus in Credit Report Analysis |

|---|---|

| Mortgages | Extensive review of payment history, debt-to-income ratio, length of credit history, and overall creditworthiness. |

| Auto Loans | Emphasis on payment history, credit utilization, and the applicant’s ability to manage monthly debt obligations. |

| Personal Loans | Assessment of credit history, debt levels, and repayment capacity. Lenders typically look for a consistent pattern of responsible debt management. |

The information discussed above demonstrates how credit reports are vital tools in the loan approval process. Understanding the elements that lenders examine allows borrowers to better manage their credit and improve their chances of securing favorable loan terms.

Impact of Credit Scores on Loan Terms: The Role Of Credit Reports And Scores In Loan Approval Process

Credit scores play a crucial role in determining the terms of a loan. Lenders use these scores to assess the borrower’s creditworthiness, which directly influences the risk associated with extending credit. A higher credit score generally indicates a lower risk for the lender, leading to more favorable loan terms.

The relationship between credit scores and loan terms is multifaceted, impacting various aspects of the loan agreement, including interest rates, loan amounts, repayment periods, and associated fees. Borrowers with strong credit profiles often secure more advantageous loan conditions compared to those with weaker credit. Understanding this relationship is essential for borrowers to maximize their chances of securing favorable loan terms.

Impact on Interest Rates

Credit scores directly influence the interest rate offered on a loan. Lenders use credit scores to estimate the probability of default. A higher credit score signifies a lower risk of default, enabling lenders to offer lower interest rates. Conversely, a lower credit score signifies a higher risk of default, resulting in higher interest rates. This difference in interest rates can significantly impact the total cost of borrowing over the life of the loan. For example, a borrower with a high credit score might receive a 5% interest rate, while a borrower with a low credit score could be offered a 10% interest rate on the same loan amount.

Relationship with Loan Terms

Loan terms, such as loan amounts, repayment periods, and fees, are also correlated with credit scores. Lenders typically offer larger loan amounts to borrowers with higher credit scores. This is because higher credit scores indicate a greater capacity to repay the loan, reducing the risk of default. Conversely, borrowers with lower credit scores may be limited in the loan amounts they can obtain. Similarly, the repayment period might be shorter for borrowers with higher credit scores, as lenders perceive them as more reliable in timely repayments. Furthermore, fees associated with the loan might be different based on the credit score, with higher credit scores often correlating with lower fees.

Correlation Table: Credit Score and Loan Terms

| Credit Score Range | Estimated Interest Rate | Potential Loan Amount | Typical Repayment Period | Associated Fees |

|---|---|---|---|---|

| 700-850 (Excellent) | 3-6% | Higher | Longer | Lower |

| 650-699 (Good) | 6-9% | Moderate | Moderate | Moderate |

| 550-649 (Fair) | 9-12% | Lower | Shorter | Higher |

| Below 550 (Poor) | 12%+ | Very Low | Very Short | Very High |

The table above provides illustrative examples of how credit scores can influence loan terms. Note that these are estimations, and actual terms offered by different lenders may vary. These figures should be considered a general guideline. Lenders often consider other factors beyond credit scores when determining loan terms.

Comparison of High vs. Low Credit Scores

Borrowers with high credit scores generally receive more favorable loan terms than those with low credit scores. High credit scores indicate a lower risk for lenders, allowing them to offer lower interest rates, larger loan amounts, longer repayment periods, and lower fees. In contrast, borrowers with low credit scores face more stringent loan terms, including higher interest rates, lower loan amounts, shorter repayment periods, and higher fees. This difference highlights the importance of maintaining a healthy credit history for securing favorable financial conditions.

Alternative Credit Assessment Methods

Traditional credit reports and scores provide valuable insights into a borrower’s credit history, but they may not be sufficient in all cases. This necessitates the exploration of alternative methods for evaluating creditworthiness, particularly when traditional data is unavailable or incomplete. These alternative methods often rely on diverse data sources to paint a more comprehensive picture of a borrower’s financial responsibility.

Alternative Data Sources

Alternative data sources offer a broader perspective on a borrower’s financial standing, complementing or replacing traditional credit reports. These sources include information from rent payments, utility bills, and even online shopping behavior. By analyzing these data points, lenders can gain a deeper understanding of a borrower’s repayment habits and financial stability. For example, consistent rent payments over an extended period demonstrate responsible financial management.

Factors Considered in Alternative Assessments

Several factors are crucial in alternative credit assessment methods. These assessments often focus on evaluating a borrower’s payment history across various financial obligations. Consistency and punctuality in fulfilling these obligations are key indicators of creditworthiness. For instance, consistently paying utility bills on time demonstrates a commitment to financial responsibility. Furthermore, the volume and types of financial transactions are considered. A steady stream of transactions, particularly those involving recurring payments, can signal financial stability. Lenders often look for patterns and consistency in a borrower’s financial activity.

Benefits of Using Alternative Credit Data

Leveraging alternative credit data can broaden the pool of eligible borrowers. Individuals who lack a robust traditional credit history, such as recent immigrants or those with limited credit experience, may find alternative credit data beneficial in securing loans. Moreover, alternative data can offer insights into a borrower’s financial behavior that traditional credit reports might miss. For instance, a consistent pattern of timely rent payments could suggest responsible financial habits that a limited credit history wouldn’t reveal.

Limitations of Using Alternative Credit Data

While alternative credit data offers valuable insights, it also presents limitations. Data accuracy and consistency can vary depending on the source and the borrower’s specific situation. Furthermore, the interpretation of alternative data can be subjective and may require specialized tools and expertise. Finally, biases inherent in the data itself may lead to skewed assessments.

Summary of Alternative Credit Assessment Methods

| Assessment Method | Strengths | Weaknesses |

|---|---|---|

| Rent Payment History | Provides insight into consistent payment habits, particularly for those with limited credit history. | Data availability and accuracy can be affected by landlords’ practices. |

| Utility Bill Payments | Demonstrates consistent financial responsibility over time. | Data may be incomplete or unavailable for certain borrowers. |

| Online Shopping Transactions | Reveals spending habits and payment capabilities. | May be influenced by short-term spending patterns rather than long-term financial stability. Potential for data manipulation. |

| Payroll Data | Provides a direct view of income and payment capacity. | Availability depends on the borrower’s employer and data sharing policies. |

Legal Considerations and Regulations

Understanding the legal framework surrounding credit reports and loan applications is crucial for both lenders and borrowers. This framework ensures fairness and transparency in the loan approval process, safeguarding the rights of all parties involved. Regulations prevent discriminatory practices and protect borrowers from inaccurate or misleading information in their credit reports.

The Fair Credit Reporting Act (FCRA) and other related laws are instrumental in governing how credit information is collected, used, and disseminated. These regulations establish clear guidelines for the responsible handling of personal financial data, ensuring accuracy and preventing abuse.

Fair Credit Reporting Act (FCRA)

The FCRA is a cornerstone of consumer protection in the United States. It Artikels the rights of consumers regarding their credit reports and provides mechanisms for disputing inaccuracies. Lenders must adhere to strict guidelines when accessing and utilizing credit reports, ensuring compliance with the FCRA’s provisions.

- Dispute Resolution: Borrowers have the right to dispute inaccurate information on their credit reports. They can submit a written dispute to the credit reporting agency, providing supporting documentation to substantiate their claim. The agency must investigate the dispute and promptly report the outcome to the borrower and any affected creditors.

- Access to Credit Reports: Consumers have the right to access their credit reports free of charge once a year. This allows them to review the information contained within and identify any potential errors. This is a vital tool for proactive credit management.

- Accuracy and Confidentiality: Credit reporting agencies must maintain the accuracy and confidentiality of the information they collect. They are obligated to safeguard personal data from unauthorized access or disclosure.

Legal Implications for Loan Applications

Compliance with the FCRA is essential for lenders during the loan application process. Lenders must follow the FCRA guidelines regarding the use of credit reports, ensuring they do not violate any regulations.

- Pre-Adverse Action Notice: Before taking adverse action (e.g., denying a loan), lenders are required to provide a pre-adverse action notice to the borrower. This notice Artikels the specific reason for the denial and informs the borrower of their right to dispute the information used in the decision.

- Verification of Information: Lenders must verify the accuracy of information contained in credit reports. This process ensures that the creditworthiness assessment is based on reliable data. Lenders should not rely solely on credit reports but should consider other factors as well.

- Consumer Rights: Understanding consumer rights is critical for both borrowers and lenders. By adhering to the FCRA, lenders avoid potential legal challenges and ensure compliance with consumer protection laws.

Relevant Legal Framework Summary

The legal framework for loan approvals and credit reporting is multifaceted, encompassing various federal and state regulations. A thorough understanding of these regulations is vital for both lenders and borrowers.

- Comprehensive Compliance: Loan providers must ensure their practices comply with the FCRA and other relevant laws and regulations. This includes verifying the accuracy of credit information, providing proper notification, and respecting the rights of borrowers.

- State Regulations: State laws can also impact credit reporting and loan approvals. These regulations may add further layers of protection for borrowers or place additional requirements on lenders. A comprehensive understanding of both federal and state laws is critical for avoiding compliance issues.

Consumer Protection and Fair Lending Practices

Protecting consumers’ rights and ensuring fair lending practices are crucial components of a healthy financial system. Lenders have a responsibility to treat all applicants fairly, regardless of their credit history or score, adhering to established regulations and avoiding discriminatory practices. This commitment fosters trust and encourages responsible borrowing.

Importance of Consumer Protection in Loan Applications

Consumer protection safeguards borrowers from predatory lending practices. It ensures that loan applications are assessed objectively and that applicants are not subjected to unfair or discriminatory treatment. Robust consumer protection regulations are vital to maintain the integrity of the lending process and foster a level playing field for all applicants. These regulations are designed to prevent lenders from exploiting vulnerable borrowers or using biased criteria.

Lender Obligations Regarding Fair Treatment

Lenders are legally obligated to treat all loan applicants fairly, irrespective of their credit score or other personal characteristics. This means that lending decisions must be based solely on objective criteria, such as the applicant’s ability to repay the loan, and not on factors like race, religion, national origin, or gender. Evaluations must be transparent and consistently applied across all applicants. Compliance with fair lending laws is paramount to maintain the integrity of the loan application process.

Consequences of Unfair or Discriminatory Lending Practices

Unfair or discriminatory lending practices can have severe repercussions for both borrowers and the financial system as a whole. These practices can lead to financial hardship for individuals and families, hindering their ability to achieve financial stability. Furthermore, such practices can erode public trust in the financial system and potentially lead to legal action and significant financial penalties for the lenders involved.

Examples of Fair and Unfair Lending Practices

| Fair Lending Practice | Unfair Lending Practice |

|---|---|

| A lender assesses loan eligibility based on the applicant’s income, debt-to-income ratio, and credit history. | A lender denies a loan application based on the applicant’s race, despite having a similar financial profile to approved applicants. |

| A lender provides clear and concise information about loan terms and conditions to all applicants. | A lender uses confusing or misleading language in loan documents to obscure the terms and conditions. |

| A lender consistently applies loan approval criteria to all applicants, regardless of their credit score. | A lender applies stricter approval criteria to applicants with lower credit scores compared to applicants with higher scores, without justifiable reason. |

| A lender explains the reasons for loan approval or denial in a clear and understandable manner. | A lender denies a loan application without providing any explanation or justification for the decision. |

| A lender complies with all applicable fair lending laws and regulations. | A lender intentionally violates fair lending laws and regulations to discriminate against certain applicants. |

Trends and Future Developments

The landscape of credit scoring and loan approval processes is constantly evolving, driven by technological advancements and shifting consumer preferences. Current trends indicate a move towards more data-driven assessments and a greater emphasis on responsible lending practices. This evolution promises to reshape how financial institutions evaluate borrowers and offer loans in the years to come.

Current Trends in Credit Scoring and Loan Approvals

Several key trends are shaping the contemporary credit scoring and loan approval process. These include an increasing reliance on alternative data sources, a heightened focus on responsible lending, and the integration of technology to automate and streamline procedures. Lenders are increasingly recognizing that traditional credit scores, while valuable, may not capture the full financial picture of a borrower. This recognition has spurred the incorporation of alternative data points, such as payment history on utilities and rent, into the assessment process.

Potential Future Developments in Technology

Technological advancements are poised to revolutionize credit reporting and loan approval systems. The rise of big data analytics and machine learning algorithms will allow for more sophisticated and comprehensive assessments of borrower risk. Predictive modeling, utilizing vast datasets, can forecast potential defaults with greater accuracy, leading to more precise risk assessment and potentially lower loan defaults. Furthermore, the application of artificial intelligence (AI) promises to automate many aspects of the loan approval process, including fraud detection and creditworthiness evaluations. This automation can accelerate the application processing time, reduce manual intervention, and potentially lower costs.

Evolving Role of Artificial Intelligence in Loan Assessments

AI is playing an increasingly crucial role in loan assessments. AI algorithms can analyze vast amounts of data, including traditional credit scores, alternative data, and even social media activity, to assess borrower risk more accurately than traditional methods. For example, machine learning models can identify patterns in borrower behavior that might indicate a higher or lower risk of default. The potential benefits of AI-powered loan assessments are significant, including the ability to identify high-risk borrowers earlier, potentially reducing the incidence of loan defaults. However, ethical considerations regarding data privacy and algorithmic bias must be carefully addressed.

Impact of Emerging Financial Technologies on Credit Scoring Systems

Emerging financial technologies, such as mobile payments and peer-to-peer lending platforms, are fundamentally altering how credit scores are generated and used. These technologies create new data streams, allowing lenders to assess borrowers based on their engagement with these platforms. For instance, consistent use of mobile payment systems, combined with responsible repayment habits, can provide valuable insights into a borrower’s financial reliability. This expanded data ecosystem provides a more holistic view of a borrower’s financial standing, potentially leading to more inclusive and equitable lending practices.

Illustrative Case Studies

Understanding the interplay between credit reports, credit scores, and loan outcomes is crucial. These case studies provide practical examples of how different credit situations affect loan approvals and terms, demonstrating the significance of responsible credit management.

Positive Impact of a Good Credit Score

A strong credit history, reflected in a high credit score, can significantly improve loan prospects. Consider Sarah, a recent graduate with a 750 credit score. She applied for a $20,000 student loan consolidation. Her excellent credit history, demonstrated by timely payments on previous accounts, resulted in a favorable loan approval with a lower interest rate of 4.5%. This rate is significantly lower than the 7% rate offered to a peer with a 650 credit score. This favorable outcome highlights how a good credit score can lead to better loan terms.

Challenges Faced by Applicants with a Low Credit Score, The role of credit reports and scores in loan approval process

Applicants with a low credit score face increased challenges in securing loans. David, seeking a $15,000 personal loan to cover home repairs, has a credit score of 580. His application was rejected by several lenders due to his less-than-stellar credit history. Lenders often view lower credit scores as a higher risk, leading to higher interest rates or loan denials. In David’s case, alternative financing options such as a secured loan or a loan with a co-signer were his only avenues to potentially secure funding.

Role of Alternative Credit Data in Loan Approval

Alternative credit data, including rent payments, utility bills, and mobile phone payment history, can supplement traditional credit reports. Emily, a self-employed artist with no traditional credit history, applied for a $5,000 business loan. Lenders, recognizing the reliability of her consistent payments on utilities and rent, considered this alternative data as a reliable indicator of creditworthiness. This demonstrated how alternative data can fill the gap for applicants lacking a comprehensive traditional credit history.

Impact of Credit Reports on a Specific Loan Application

Consider the case of Mark, applying for a $100,000 mortgage. His credit report revealed several late payments on past accounts, resulting in a credit score of 680. While his application was not immediately rejected, the late payments negatively impacted the interest rate offered. The lender, assessing the risk associated with the past delinquencies, offered a higher interest rate of 6.2%. The lender emphasized that his overall credit profile, including current employment and income stability, also influenced the decision.

Commonly Asked Questions

What is the typical time frame for a loan application to be processed?

Processing times vary significantly based on the loan type and the lender. Some applications may be processed within a few days, while others might take several weeks. Factors such as loan amount, creditworthiness, and lender policies all play a part in the timeline.

Can a borrower dispute inaccuracies on their credit report?

Yes, borrowers have the right to dispute inaccuracies on their credit reports. The Fair Credit Reporting Act (FCRA) Artikels the procedures for disputing errors and the lender’s obligations in handling such disputes.

How do different types of loans (e.g., mortgages, auto loans) assess creditworthiness differently?

Different loan types place varying emphasis on specific aspects of credit history. For example, mortgages often require a more extensive credit history and a higher credit score, while auto loans might prioritize recent payment history. Lenders also use different scoring models and criteria.

What are the potential consequences of unfair or discriminatory lending practices?

Unfair or discriminatory lending practices can lead to legal repercussions for the lender and potential financial damages for the borrower. Regulatory bodies and consumer protection organizations are in place to ensure fair treatment in the loan application process.

Credit reports and scores play a crucial role in determining loan eligibility. Understanding how lenders assess creditworthiness is vital for securing favorable loan terms. This involves factors such as calculating the total interest paid over the life of a loan, a key aspect in loan affordability. calculating the total interest paid over the life of a loan can significantly impact the overall loan cost.

Ultimately, a good credit history, reflected in positive credit reports and scores, is essential for a smooth loan approval process.

Understanding your credit report and score is crucial for navigating the loan approval process. Knowing your creditworthiness empowers you to make informed decisions and avoid potentially harmful lending practices, such as those detailed in strategies for avoiding loan scams and predatory lending practices. Ultimately, a strong credit profile, coupled with careful research and awareness of potential risks, will help you secure the best loan terms possible.

Credit reports and scores play a crucial role in determining loan eligibility. Understanding these factors is essential for securing favorable loan terms. For instance, if you have a high-interest rate loan and are seeking to lower your monthly payments, exploring options for refinancing, such as those outlined in options for refinancing a high interest rate loan to lower monthly payments , can significantly impact your financial situation.

Ultimately, a strong credit profile, reflected in a good credit score, often leads to better loan approval outcomes.